The recently published Nielsen Global Report 2025 identifies three main focus areas: adapting media budgets, balancing performance and brand-building efforts, and improving marketing effectiveness measurement. Below is an analysis of two primary priorities.

Revenue growth vs. brand building

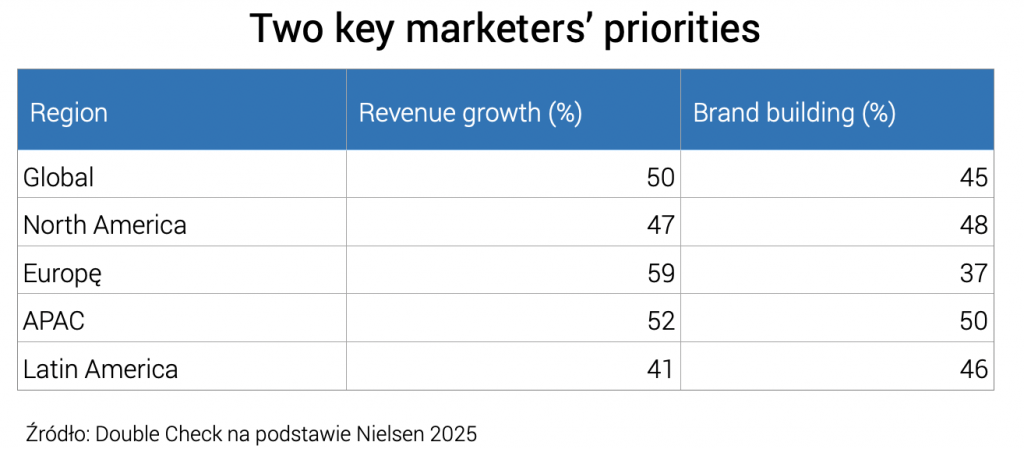

The number one priority for marketers globally remains direct sales and revenue growth. Half of global respondents indicate revenue growth as one of their two most important marketing goals, surpassing brand awareness building. The table below shows how these priorities vary by region. Europe stands out globally – as many as 59% of European marketers place revenue growth as their top priority, while brand building is key for only 37%. The opposite trend is seen in Latin America, where branding slightly dominates (46% vs. 41%). North America and Asia-Pacific maintain a balanced approach – marketers in these regions report an almost perfect split between sales and branding goals (e.g., in North America: 47% vs. 48%).

Retention vs. acquisition

Interesting differences also emerge in the secondary marketing goals. European marketers—facing demand stagnation—place greater emphasis on retaining existing customers than on aggressive acquisition. In Europe, loyalty building and retention appeared more frequently among top priorities (43%) than new customer acquisition (35%). In contrast, in emerging regions such as Asia and Latin America, marketers are equally—or even more—focused on acquiring new audiences, although retention is still highly valued (e.g., 40% in Latin America). Globally, these two areas are almost equally weighted, with around 38% of marketers prioritizing retention and 37% emphasizing acquisition. This suggests that marketers understand the importance of balancing top- and bottom-of-funnel efforts. How can this balance be achieved? The key lies in adopting a full-funnel approach—investing in brand and customer relationships to lower long-term customer acquisition costs and boost overall ROI.

Balancing performance and branding; digital vs. traditional media

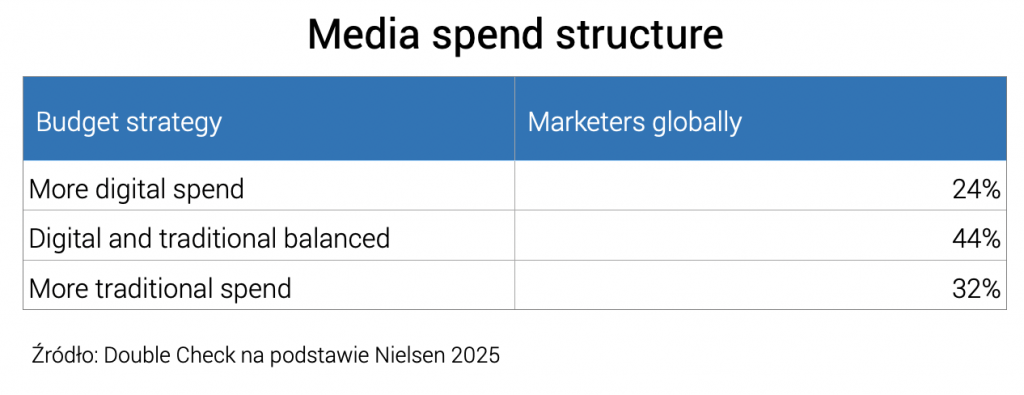

Marketers in 2025 are clearly seeking balance in media budget allocation. Globally, 44% of advertisers report a balanced media spend, split between digital and traditional channels. Interestingly, not everyone is rushing toward full digitalization: nearly one-third (32%) still plan to focus primarily on traditional media, while 24% prioritize digital. In other words, most top marketers prefer a hybrid strategy over extremes. The most evenly balanced approach is seen in Latin America, which shows the closest-to-50/50 ratio between digital and traditional media. In North America and Europe, the share of companies leaning toward digital is slightly higher, but even there the dominant trend is diversification.

Performance vs. brand: two poles of a unified strategy

Balancing the budget is one thing—but reconciling short- and long-term goals is equally critical. For years, it was widely believed that performance (sales-driven) investments were in conflict with brand-building efforts. However, recent data suggests that marketers are learning to integrate both. The previously mentioned 40/60 split between digital and traditional media spending is a clear sign of this shift. Companies are moving away from the siloed logic of “digital vs. everything else” and are embracing a holistic view of their media strategies.

In practice, more organizations are beginning to allocate dedicated budgets for brand-building initiatives (e.g., image campaigns, content marketing) to ensure long-term objectives aren’t overshadowed by the push for immediate returns. This mindset is particularly evident in Asia and North America, where marketers are establishing standalone brand funds. In Latin America, it’s more common to define separate KPIs for short-term and brand-driven campaigns—enabling distinct measurement frameworks and reducing internal budget competition.

360° synergy – only possible through traditional + digital media

Why maintain a media mix instead of going fully digital? Evidence indicates that traditional channels can amplify the effectiveness of digital media by acting as performance catalysts. For example, Nielsen studies reveal that adding radio to an online campaign increases both total reach and sales impact more than when those channels operate in isolation. Similarly, combining linear TV with Connected TV (CTV) yields superior results compared to using either on its own. Marketers are increasingly recognizing these cross-channel synergies. As a result, there’s a growing preference for “test and learn” strategies instead of prematurely cutting traditional media. In 2025, hybrid approaches—combining performance and brand efforts across media—outperform narrow, one-dimensional tactics.