As many as 94% of advertising agencies in the United States recommend that their clients test new media channels, which seems to be a sound strategy. In fact, 85% of marketers have already used at least one new media channel, such as Retail Media, gaming, virtual reality (VR), augmented reality (AR), or digital audio, according to a report from Integral Ad Science.

The rise in the importance of Retail Media (78%) as a new media channel utilized by marketers is not surprising, considering its dynamic growth. The next most commonly used channels are VR/AR (71%), digital audio (68%), and gaming (47%).

Looking ahead, the channel where the largest number of respondents (69%) plan to increase their advertising spending over the next year is virtual reality. The next in line are Retail Media (65%) and augmented reality (60%).

Interestingly, although both brand-related and performance goals are important for marketers when advertising on new media channels, respondents slightly more often cite brand building and increasing brand awareness (31%) as a key marketing objective, compared to increasing sales and improving return on investment (ROI) (26%).

We can also observe some differences in approach in the market regarding this topic. Advertisers, when running campaigns on new channels, more frequently focus on brand objectives (56%) than on sales objectives (44%). Meanwhile, agencies show a slight preference for sales objectives (51%) over brand objectives (47%).

Specifically, advertisers in the telecommunications, automotive, and financial sectors are more inclined to prioritize brand-related goals. In contrast, those in the retail/QSR, media and entertainment, and technology sectors more often focus on sales goals.

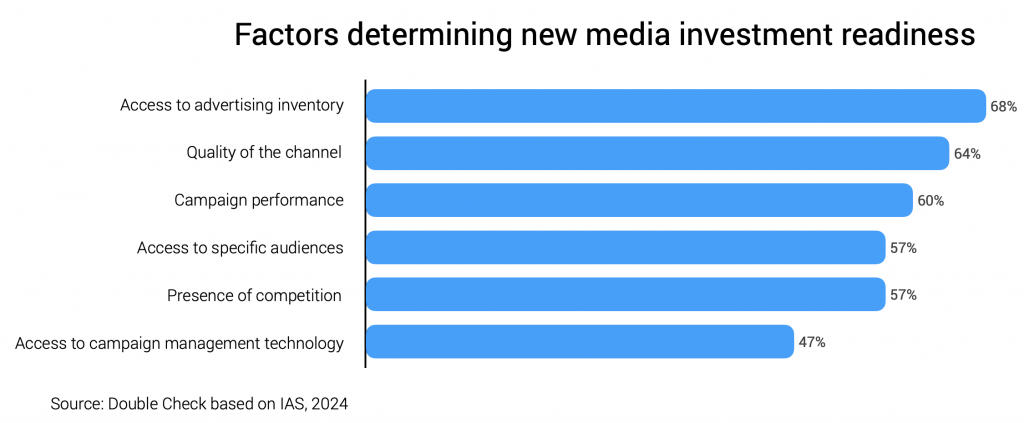

The decision to invest in a new media channel or prioritize it depends on several factors. The most commonly mentioned factor is the potential for future technological innovations on the channel (42%). This is one of three inventory-related factors (price, availability, quality), which together were cited by two-thirds of respondents (68%).

Another frequently mentioned factor determining the attractiveness of a channel for investment is the ability to reach target demographic groups (41%). However, the two audience-related factors (reach and popularity) had a combined respondent share (57%) lower than others.

Respondents more often indicated media quality factors (64%) as influencing the decision on a channel’s readiness for investment. The most important of these factors is the alignment of the channel’s content with the brand or campaign message (39%).

Six out of ten respondents indicated at least one performance-related factor as significant when deciding to invest in a new media channel. Among them, the most important is the high potential for return on investment (ROI) (39%).

By comparison, fewer respondents (47%) consider operational factors (buy-side processes) crucial when making decisions about priorities for a new media channel.